In this project for MAT 553 - Stochastic Models, I investigated the returns of registered index-linked annuities. Registered index-linked annuities (RILAs) are a new type of investment vehicle that provides exciting potential for growth with some protection from downside risk. The key difference between a RILA and a traditional fixed income annuity is that the return of the RILA depends on the performance of its linked index. Allianz Life, a large and well-known financial institution, offers several RILA products, each with different methods of determining the credited interest rate. The goal of this project was to model the returns of these products, define a probability distribution for the returns, and finally to make a recommendation on which product to pick for a six-year long crediting period.

The RILAs in question are linked to the performance of the S&P 500 index. Thus, the first task was to simulate the return of the S&P 500 over the next six years. To do this, I modeled the S&P 500 as geometric Brownian motion and ran 100,000 simulations of its returns. To estimate the parameters μ and σ, I used their maximum likelihood estimators obtained from the daily closing price of the SPY exchange-traded fund from the start of 2003 to the end of 2023. Once the parameters were obtained, I simulated the S&P 500 for 1512 days using a standard Euler-Maryuama method.

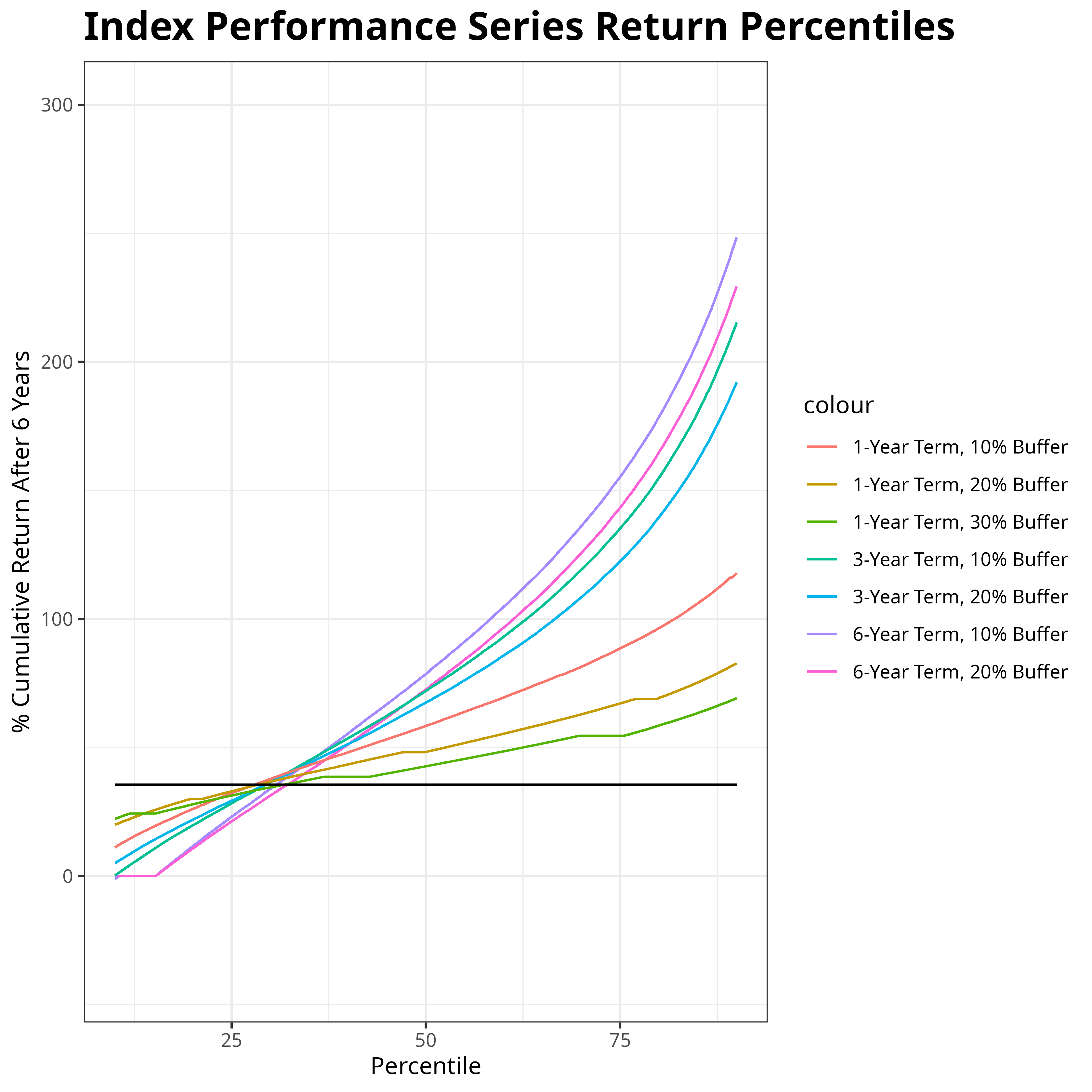

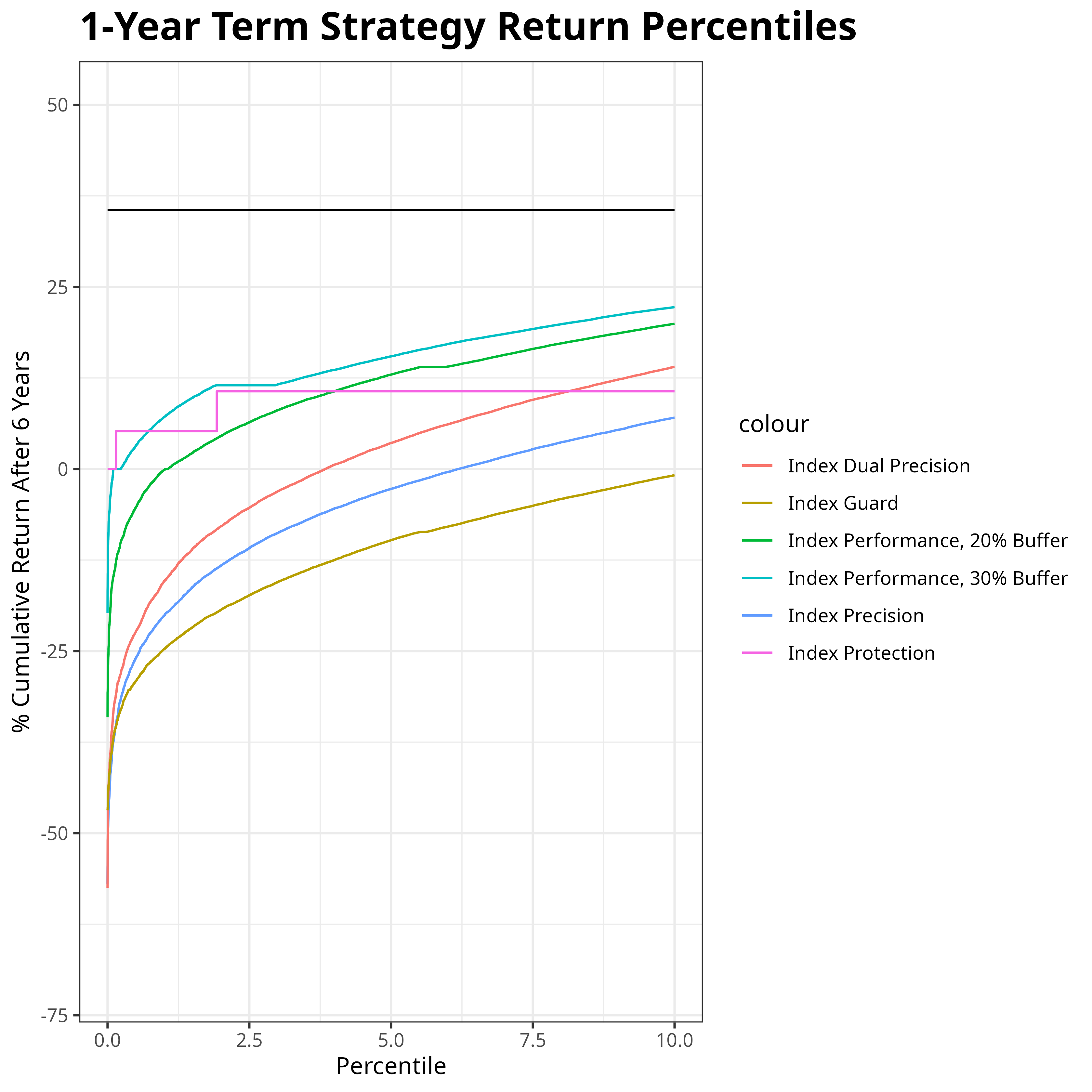

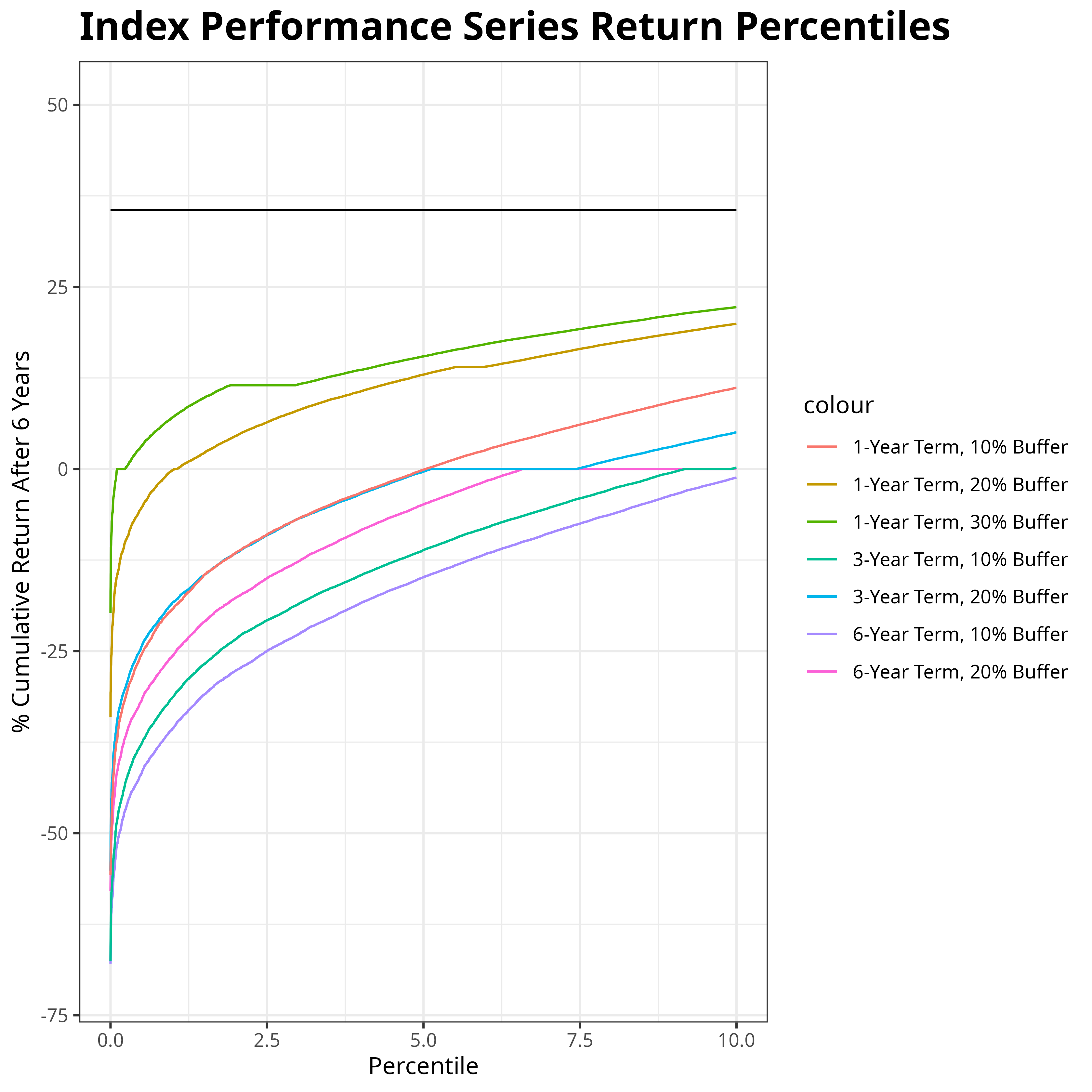

The recommendation was meant for a person nearing retirement, so downside risk was a serious concern. This meant that it would be worth sacrificing the highest end of returns to gain safety, so I focused on the bottom 10% of returns for the annuities in my analysis. In particular, I measured the 0.1%, 1%, and 10% worst returns against the likelihood of beating a fixed instrument that offers a 5.2% annual return (cumulative 35.5%) over 6 years. By this metric, I recommended the Index Performance 1-Year Term with 20% buffer.

Disclaimer: I am not a fiduciary, and this is not financial advice.

Source code, slides, and report can be found in the repo.